Moreover in the case of severe disabilities the deductions can. The tax exemption is effective from Jan 1 2022 to Dec 31 2026.

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

As per the revised tax exemption act effective April 1 2017 When you make donations above 500 to Akshaya Patra your donation amount will be eligible for 50 tax exemption under Section 80G of Income Tax Act.

. The exemption is calculated by reducing the. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. How To Maximise Your Income Tax Refund Malaysia 2022 YA2021.

Tax Exemption Limit per year Petrol travel toll allowances. Income tax under an income tax treaty. 50 of the employee salary is eligible for HRA tax exemption if he or she lives in any of the Metro cities of India.

In addition to the 150000 Baht tax exemption threshold. Tax Exemption On Rental Income From Residential Houses. How To File Your Taxes For The First Time.

Our Malaysia Corporate Income Tax Guide. Citizen or resident spouse to be treated as a US. How To File Income Tax As A Foreigner In Malaysia.

The Income Tax Act Section 10-13A provides for HRA exemption of tax. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. If a nonresident alien individual has made an election with his or her US.

KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of the tax initiative said the Ministry of Finance MoF. Read this personal income tax guide in Singapore to find out what tax. Expatriates working in regional operation centres in Malaysia that are accorded specified tax incentives are taxed only on the portion of chargeable income attributable to the number of days the employment is exercised in Malaysia.

Exemption for an expatriate receiving fees as a director of a Labuan entity until YA 2025. Malaysia Residents Income Tax Tables in 2021. HRA Tax Exemption for the Salaried Individuals.

More on Malaysia income tax 2019. Malaysia Residents Income Tax Tables in 2022. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. Expenses incurred towards promotional expenses overseas can be double deducted.

In such cases Rs 50000 can be deducted from their taxable income. Malaysia Thailand and Indonesia which are all not more than two-hours flight away from Singapores world-class Changi airport. This means that if you are aware of a 2021 tax exemption or 2021 tax allowance in Malaysia that you are entitled too BUT it isnt listed here.

How To Pay Your Income Tax In Malaysia. My support is about THB 30000 per month from family. All educational equipment imported towards these schools is exempted from import duty.

Subject to Inland Revenue Board criteria and guidelines income tax. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. A NOR taxpayer gets to enjoy tax exemption on contributions made by the employer to a non-mandatory overseas pension fund which would.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. This was highlighted in the revised Guidelines for Application Of Approval Under Subsection 446 Of The Income Tax Act 1967 dated 15 May 2019. The House Rent Allowances that is given by the employer.

To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions. I have closed my tax file in Malaysia when I relocated to Thailand. This means that if you are aware of a 2022 tax exemption or 2022 tax allowance in Malaysia that you are entitled too BUT it isnt listed here.

A company or corporate whether resident or not is assessable on income accrued in or derived from Malaysia. According to the document organisations are requested to issue official tax exemption receipts only for donors who have provided all required particulars. Salaried Employees CTC Income Tax Calculation.

Resident for income tax purposes the nonresident alien may not claim to be a foreign resident to obtain the benefits of a reduced rate of or exemption from US. The deduction will be the lowest amongst. Guide To Using LHDN e-Filing To File Your Income Tax.

As per section 80U anyone suffering from a disability is eligible to get an extra income tax exemption from their taxable income. Take a look at tax rules for reimbursement conveyance variable pay bonus DA Gratuity HRA Written by Rajeev Kumar February 19 2022 24820 pm. 100 tax exemption on QCE incurred within 5 years and this is to be used for a statutory income offset of 70 or 70 exemption on income tax for a period of 5 years.

Find out how much Thailand income tax youll pay when working or retiring here and the deductions and allowances you can claim back. These tax incentives appear in various forms such as exemption on income extra allowances on capital expenditure incurred double deduction of expenses. Tax Offences And Penalties In Malaysia.

How To File Your Taxes Manually In Malaysia.

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Income Tax Relief Items For 2020 R Malaysianpf

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Malaysia Personal Income Tax 2021 Major Changes Youtube

Finance Malaysia Blogspot Personal Income Tax For Ya2019 What Life Insurance Category Changed

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Personal Tax Relief 2021 L Co Accountants

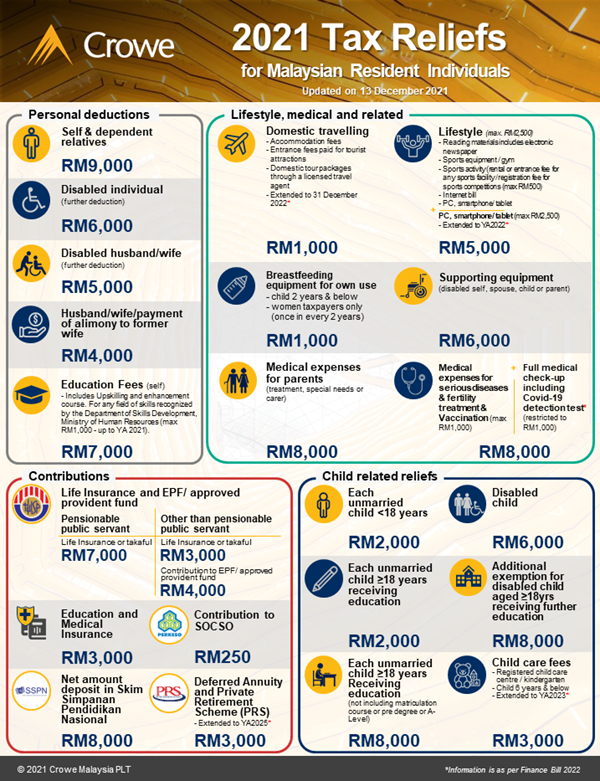

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Lhdn Irb Personal Income Tax Relief 2020

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Personal Income Tax Guide In Malaysia 2016 Tech Arp